How to Find a Financial Advisor That Works for You

Not all financial advisory firms, or the advisors who work for them, are created equal.

When you’re ready to work with a financial advisor, finding the right one – someone who takes the time to learn about you and your goals and then works with your best interest in mind – may seem like a tall order.

After all, there are firms practically everywhere you turn. And every one of them promises to look after your needs better than the competition.

So how can you cut through the noise and actually determine the best fit for you? We’ve broken down the basics to help you truly understand the differences between all of the options out there.

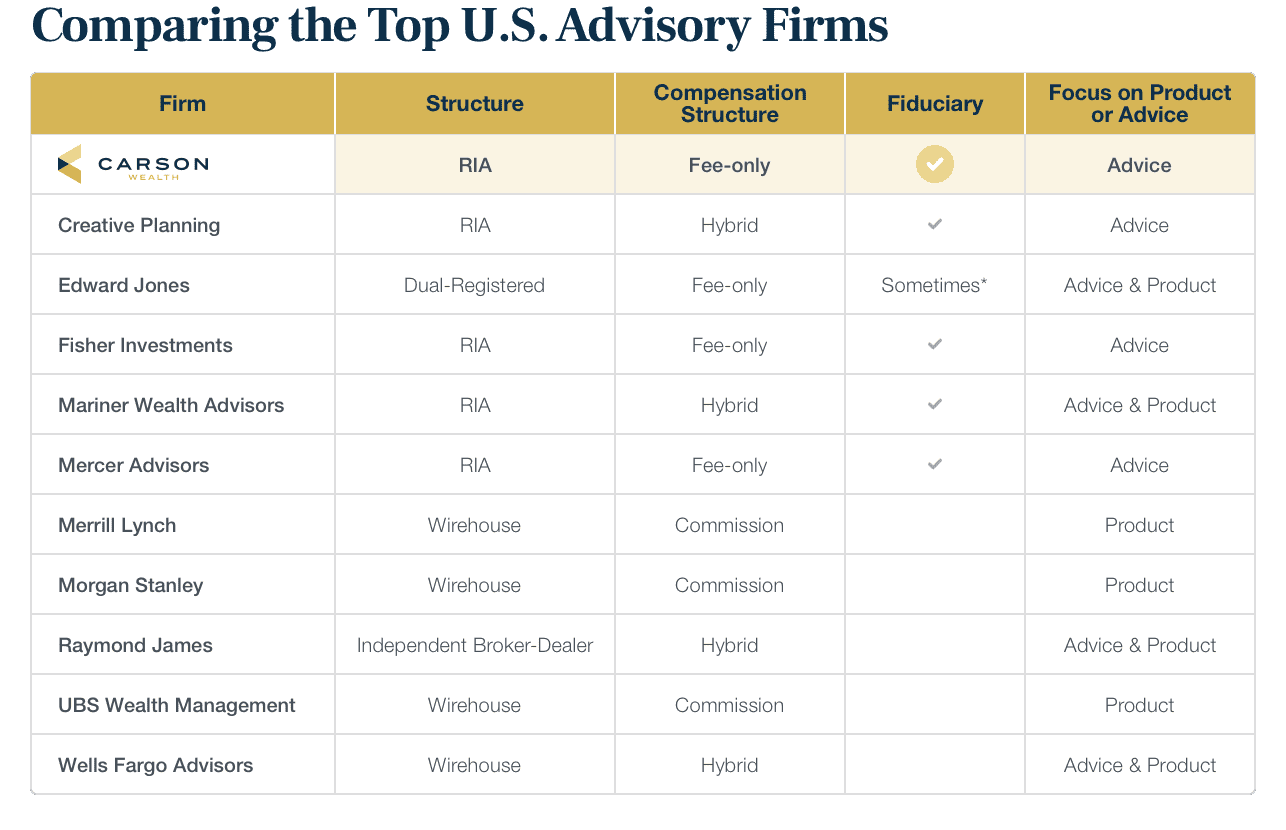

See how Carson Wealth stacks up to the top U.S. advisory firms in our comparison chart.

Types of Financial Advisory Firms and the Advisors Who Work There

When looking for a financial advisor to work with, you’ll probably encounter different terms and professional designations thrown around. This can be confusing, even for the more experienced investor. Let’s take a closer look at what each type of wealth management firm does and define who works in each.

Wirehouses

are full-service broker-dealer firms of any size that provide a wide range of financial services, such as wealth management, tax planning, retirement planning, investment banking, trading and research. These firms share their financial information, research, and pricing, with multiple branch offices – historically, via telephone or telegraph wire which is how they earned their name. Today, the four largest national wirehouses are Merrill Lynch, Morgan Stanley, UBS and Wells Fargo.

Wirehouse Brokers

are Series 6 or 7 Registered Representatives who work for a wirehouse. These representatives are non-independent, meaning they’re restricted to only the products and services dictated by their employer.

An Independent Broker-Dealer

is an individual or a firm that’s registered with the Financial Industry Regulatory Authority (FINRA) to buy and sell securities for its own account or on behalf of its customers. These firms and individuals differ from broker-dealers in that they can sell a variety of non-proprietary investment options, giving them and their clients more diversity to choose from.

A Registered Investment Advisor (RIA)

is an independently owned firm that’s registered with the Securities Exchange Commission (SEC) to advise clients on their investments and may manage their portfolios.

Investment Advisory Representatives (IARs)

are the registered financial advisors working for an independent RIA or an RIA established by a broker-dealer.

A Dual-Registered Advisor

can be a firm or an individual that’s registered with FINRA as a broker-dealer/registered representative and with the SEC as an RIA/IAR.

Looking For a Financial Advisor Who’s on Your Side?

We can help match you with a professional in your area who will put your financial goals first.

How Do Financial Advisors Get Paid?

There are two primary ways for financial advisors to earn money: commissions and fees. Some charge just one way, while others take on a more hybrid structure. Here’s a breakdown of what each means for you.

Commission-Based Financial Advisors

earn a set amount for every transaction they perform and the products and services they sell. In other words, every time one of these advisors does something on your behalf, they get paid. Wirehouse brokers and insurance advisors generally use this compensation model.

Fee-Based Financial Advisors

are usually IARs. These financial advisors charge their clients a predetermined amount for their services in one of the following ways:

- Hourly rate

- Monthly or annual retainer

- A percentage of your assets under management (AUM)

Most RIA firms and their advisors charge the AUM model, and it’s important to note that these advisors’ incomes are tied directly to their clients’ assets. If their clients do well, they do well.

Hybrid Financial Advisors

may be IARs with both an RIA and a broker-dealer, although some wirehouses have adopted the hybrid compensation structure as an option. Under this model clients are charged a flat fee plus commissions on certain transactions.

On the surface, it may seem like the way you pay for your advisory services doesn’t make much of a difference. After all, they have to make their money somehow.

But think about it this way. When the advisor you’re working with is incentivized to sell a product or service to earn their money, can you be absolutely sure that they are working in your best interest, or for their own gain?

Which brings us to our next subject: fiduciaries.

What Is a Fiduciary and Why Should I Work With One?

Fiduciaries are individuals or organizations that are legally and ethically bound to act in the best interest of others. There are many professions that have fiduciary requirements including lawyers, estate executors and real estate agents. The financial advisory industry also has fiduciaries.

But not all financial advisors are required to be fiduciaries.

Broker-dealers are required to follow Regulation Best Interest (REG BI) instead. According FINRA, this rule establishes a “best interest” standard of conduct that broker-dealers must follow when recommending a transaction or investment strategy that involves securities. They must also provide a brief relationship summary, called a Form CRS, to retail investors.

In contrast, RIAs are bound to the fiduciary standard which requires them to abide by two duties:

- Duty of care – This requires advisors to make informed business decisions only after critically reviewing all available information.

- Duty of loyalty – This prohibits advisors from acting in their own self-interest.

What does this mean for you? When working with a fiduciary advisor, you know that your advisor is legally bound to disclose any conflict of interest and put your needs above their own. In other words, they can offer you the greatest standard of care in the industry.

Work With an Advisor Who’s Legally Bound to Put You First

We have advisors around the country who are ready to help you pursue your definition of freedom.

How Do the Top Financial Advisory Firms Compare?

Now that you understand the differences between the various types of advisory firms, how they earn money, and what kind of advice they can provide, let’s take a closer look at where some of the firms you may be considering would fall.

Ready to Begin Working With a Financial Advisor?

We can help you find someone in your area who’s ready to help you pursue your financial goals. They can answer all of your questions and help you understand the benefits of working with an independent advisor who will put your needs first.