As a CPA, one of the questions that I have been getting more frequently is, “What is a donor-advised fund?” This is not surprising as the number of individual donor-advised fund accounts has grown by over 50% for the second year in a row, according to the National Philanthropic Trust’s 2019 DAF Report.

Let’s explore how they work, why they are beneficial from a tax perspective, and some special deduction rules for charitable contributions that are new for 2020.

How a Donor-Advised Fund Works

A donor-advised fund is a fund that you can make tax-deductible donations to, the donations can grow tax-free, and you can support your favorite charities now and in the future.

You receive the tax deduction when you place the assets in the donor-advised fund, not when the funds are distributed out to the charity of your choice.

You can place many types of assets into a donor-advised fund including cash, stocks and real estate. Most people donate appreciated stocks into the fund because of the added tax benefit. You can take a deduction for the fair market value of the stock (as opposed to your purchase price) if you’ve held the stock for a year and never recognize the gain on the stock. (You would have to recognize the gain on the stock if you sold it outright.) You can donate appreciated stock directly to a qualifying charity. Keep in mind some small charities don’t have the resources or experience to know how to handle a stock gift.

How to Take Advantage of a Donor-Advised Fund’s Tax Benefits

Taking a tax deduction when you place your assets in the donor-advised fund is a powerful tax benefit. It’s strategic to time the deduction to coincide with a year that you receive a large bonus, sell a company, or have another extraordinary income event. You can take the deduction in the year you are in a higher tax bracket to help reduce your tax liability and front-load your donor-advised fund. The assets in the fund can fuel donations now and/or in the future.

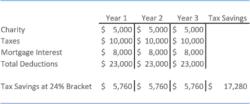

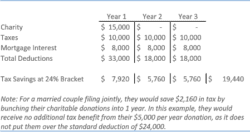

Even if you do not have a big income event, you may want to consider “bunching” your donations every couple of years. Many people who previously itemized their deductions are now using the increased standard deduction. For example, if you don’t think you will be over the standard deduction with your normal yearly gifting, you may want to donate 3-5 years’ worth of donations into the donor-advised fund in the current year. You can then take advantage of the itemized deduction in the high-donation year, take the standard deduction in the subsequent years, and disburse the funds to charities over the next three to five years ratably as you typically would on a yearly basis.

Tax Picture with a Yearly Charitable Donation

Tax Picture with a Front-loaded Donor-Advised Fund

3 Things to Know When Considering a Donor-Advised Fund

1. Do Not Let the “Tax Tail” Wag the Dog.

You should not let the tax advantage be the deciding factor in donating to a donor-advised fund. Once you make the donation, you cannot get the assets back out of the fund for personal use.

2. You Control the Fund.

You decide the timing of the donations into the donor-advised fund and out of the fund to the public charity, or multiple charities, of your choice. Donor-advised funds have been receiving some negative press as a black-hole that people use to receive a tax deduction, and then do not distribute the assets out to charity. The choice of when to distribute funds to charities is strictly up to you, the donor. You control your donor-advised fund, the investments inside the fund, and the distribution of the assets.

3. Know The Minimum Requirements.

There are minimum donations required to establish a donor-advised fund, minimum subsequent donations, and minimum gifts to charity set in place by the major institutions that run donor-advised funds. There are also annual administrative fees charged to maintain the fund at the institution. Be sure to compare minimums and fees.

Donor-Advised Funds and Special Deductions For 2020

The Coronavirus Aid, Relief, and Economic Security (CARES) Act was signed into law in March 2020 and includes several modifications to the charitable giving laws for 2020.

Donors who itemize their deductions can now give more to charitable organizations before reaching their adjusted gross income (AGI) limitation. Formerly set at 60%, the limitation for cash contributions to certain public charities has now been raised to 100% of an individual’s AGI for 2020. Any giving beyond this 100% limitation may be carried over and used in the next five years. This provision excludes giving to private foundations and donor-advised funds.

This means that donors who exhaust the 60% limit with cash contributions to their DAFs in 2020 could make any additional donations outside their DAF and have those donations qualify for a deduction (up until reaching the 100% limit).

DAF donors who take the standard deduction will be able to take a $300 above-the-line deduction for cash donated to a qualified nonprofit. Only people who don’t itemize can use this charitable deduction and only cash donations qualify. Donated stock, furniture, clothes and canned goods do not. Neither does planned giving to donor-advised funds or foundations.

Reach out to your advisor today and have them help you with 2020 tax planning to maximize your tax deductions and the impact that you can have on the world around you.

—

The opinions are those of the writer, and not the recommendations or responsibility of Cetera Advisor Networks LLC or its representatives.